INVESTMENT CONSULTING

We believe that wealth alone does not create a meaningful life — connecting your wealth with something bigger does. That is where the financial plan shines. And the means to create your meaningful life? That is the mission of investment consulting. Achieving your someday depends on the successful integration of your financial plan with your investment strategy.

INVESTMENT CONSULTING OVERVIEW

INVESTMENT PORTFOLIO DESIGN

*This has likely been completed as part of the financial planning process.

*This has likely been completed as part of the financial planning process.

The culmination of this step is the Investment Policy Statement.

We take a multi-dimensional approach to portfolio construction, combining different asset classes, geographic regions, and investment styles.

We ensure that the strategy is achieving the stated objectives, confirm that the individual investments are performing to expectation and measure and evaluate the portfolio performance versus indexes and peer groups.

We review stated objectives, evaluate market conditions and make changes to portfolio or strategy if warranted to reflect changes in the market environment or client circumstances.

WHAT WE PROVIDE

- Development of a customized Investment Policy Statement that aligns with your financial goals

- Asset allocation unique to your time horizon, risk tolerance and stated goals

- Strategic placement of assets across accounts to optimize tax efficiency

- Low-cost, low-fee institutional money management

- Rebalancing with tax loss harvesting

- Consolidated portfolio performance statements

- Full integration with your financial plan

OUR INVESTMENT PHILOSOPHY

- Investing is a means to an end – building, managing, and monitoring low-cost portfolios designed to reliably achieve your financial goals is our priority, not outperforming arbitrary market benchmarks.

- Markets are efficient and attempts to “beat” the market – whether through stock picking, manager selection, or market timing – are highly unlikely to succeed and are costly.

- Strategic allocation between equities (for growth) and fixed income (to reduce portfolio volatility) based on your time horizon, risk tolerance and stated goals.

- Diversify broadly across asset classes and geographies to minimize risk and capture market returns.

- Rebalance systematically based on asset allocation and avoid attempts to time the market.

- Low-cost, tax conscious, passive investment methodology implemented using low-cost mutual funds, exchange traded funds (ETFs) and index funds when appropriate.

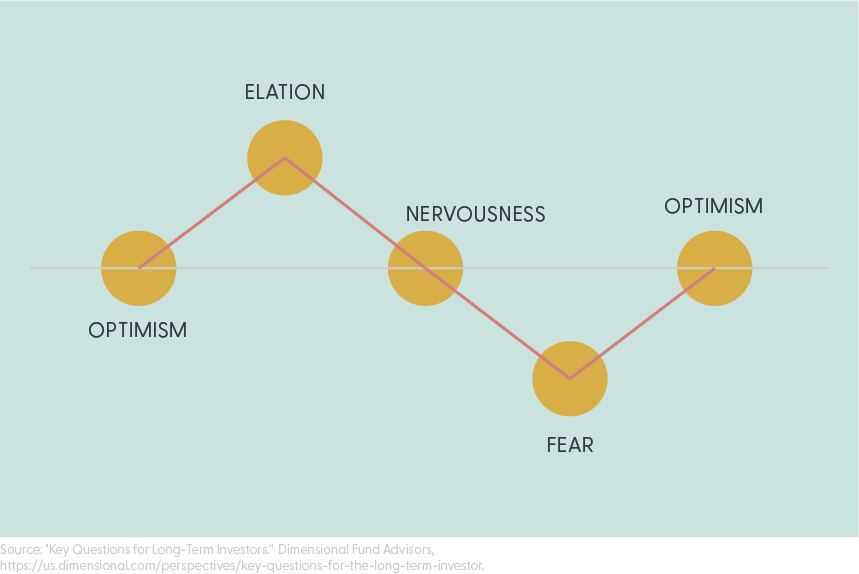

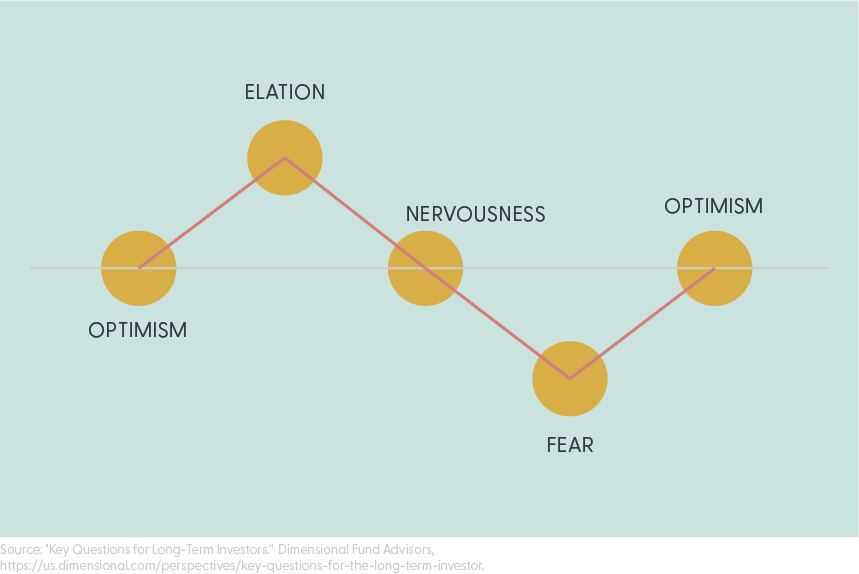

Avoid Market Timing

Source: “Pursuing a Better Investment Experience.” Dimensional Fund Advisors.

SPECIFIC FOCUS ON BEHAVIORAL FINANCE

At Someday Advisors, we offer behavioral finance coaching to ensure you stick to your investment plan regardless of market turbulence, daily news cycle or personal circumstances and biases. For further discussion, visit our relationship cultivation page here.

SPECIFIC FOCUS ON BEHAVIORAL FINANCE

At Someday Advisors, we offer behavioral finance coaching to ensure you stick to your investment plan regardless of market turbulence, daily news cycle or personal circumstances and biases. For further discussion, visit our relationship cultivation page here.

SPECIFIC FOCUS ON BEHAVIORAL FINANCE

At Someday Advisors, we offer behavioral finance coaching to ensure you stick to your investment plan regardless of market turbulence, daily news cycle or personal circumstances and biases. For further discussion, visit our relationship cultivation page here.

OUR APPROACH TO INVESTMENT CONSULTING

EVIDENCE-BASED

Our approach focuses on market efficiency and asset allocation, not market timing, manager selection or stock picking. We believe the best results are achieved with a goal-focused and planning-driven approach.

DISCIPLINED MANAGEMENT

Emotions, especially fear, cause many investors to buy high and sell low, often derailing a well-planned long-term strategy. Disciplined investment consulting is designed to withstand market dips and swings.

BEYOND THE NUMBERS

We help you understand the negative impact various factors, including upbringing, heuristics and financial biases, can have on the investing strategy and ultimately the outcome of the financial plan.

OTHER SERVICES

FINANCIAL

PLANNING

Live the life you desire both now and in the future by partnering with us to design a plan for your finances rooted in your goals, values and vision.

RELATIONSHIP

CULTIVATION

Achieve optimal outcomes through a trusted relationship built on our understanding of behavior finance and commitment to compassionate communication.

PROJECT BASED

FINANCIAL PLANNING

Meet with a CERTIFIED FINANCIAL PLANNER™ professional to get guidance on your highest-priority questions without a full commitment.

READY TO TAKE THE FIRST STEP?

We look forward to meeting you and hearing how we can help you.